-

Brand development in a changing world

Brand development in a changing worldAndrew Martin (2014)

While “Belles & Whistles” may appear to be a history of some steam trains in the UK, it is also a good case study of the development of brands in the face of competition and changing demands. The UK rail industry needed to retain passengers and found many enticing ways to do this. This book records the age of the Brighton Belle, The Golden Arrow, and the Flying Scotsman and shows how these ‘products’ developed and became part of the national psyche. The enduring nature of these ‘brands’ contains lessons for anybody interested in brand development and how the products support this – and vice versa.

-

Disruptive innovation

In 1976, when vinyl LPs were the main choice for listening to recorded music, Garrard Engineering was one of the major companies producing turntables. They covered the mass market and the high quality market, with a world-wide reputation. Their R&D department focused on creative new additions to the product range, and one small team focused on an entirely disruptive technology: the video disc.

At that time, very few companies in the world were working on this technology, so Garrard’s R&D work was a disruptive innovation. It was also ground-breaking in the demands for technology. One of the key components in the system was a laser to read the video disc. At that time, lasers were scarce items. During the design and development phase, the team needed to estimate the likely product cost. When the team contacted a major laser manufacturer for volume pricing, they were told, “Nobody will ever want 1,000 lasers.”

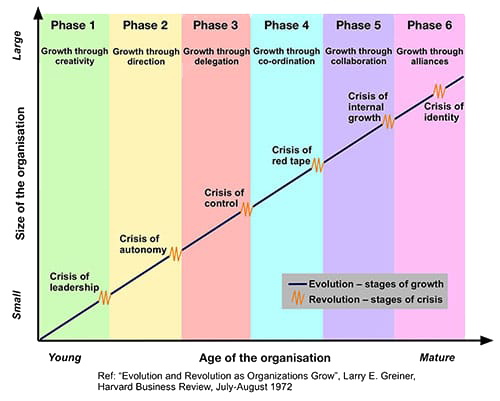

At that time, very few companies in the world were working on this technology, so Garrard’s R&D work was a disruptive innovation. It was also ground-breaking in the demands for technology. One of the key components in the system was a laser to read the video disc. At that time, lasers were scarce items. During the design and development phase, the team needed to estimate the likely product cost. When the team contacted a major laser manufacturer for volume pricing, they were told, “Nobody will ever want 1,000 lasers.”The Greiner curve could have been derived from the growth of Garrard. At the time of this disruptive innovation, they had become a small part of the large defence and technology company, Plessey. Effectively, Garrard was in the Phase 6 of the Greiner curve. When it became clear that the future development costs for this disruptive technology would be too much for Garrard alone, the team went around the Plessey organisation to find a stakeholder who would recognise the potential value of the technology, and act as a sponsor for its development.

The team’s creative vision for this disruptive technology was not recognised by any other part of the Plessey organisation – and was seen as competing with another higher technology system (which never saw the light of day, as opposed to the CD/DVD). As a result, the project died for lack of funding. This case study is a lesson in managing competing technologies within a portfolio, and the problem of knowing when to keep funding, or when to cut funding, of innovation.

The team’s creative vision for this disruptive technology was not recognised by any other part of the Plessey organisation – and was seen as competing with another higher technology system (which never saw the light of day, as opposed to the CD/DVD). As a result, the project died for lack of funding. This case study is a lesson in managing competing technologies within a portfolio, and the problem of knowing when to keep funding, or when to cut funding, of innovation.Within 10 years, four things happened:

- CD technology had become a dominant medium for music and data storage across the globe, and a commodity product

- Plessey had gone out of business,

- Garrard had been sold to one of its distributors, and

- Lasers had become commodity items.

NOTE: This case study is drawn from personal experience; it is not a formally approved case study from Plessey or Garrard.